hawaii state tax id number

Full Legal Name as is or will be registered in Hawaii. Instead we have the GET which is assessed on all business activities.

Yahoo Finance On Twitter Low Income Housing Map Minimum Wage

Sales HI State Tax ID Number Sellers Permit Federal Employer Tax ID Number.

. Contact Email and Phone Number of. You can even apply to multiple agencies using their wizard process. The Hawaii State Tax ID.

Hawaii Tax Online currently supports General Excise Transient Accommodations Withholding Use Only Sellers Collection Corporate income Franchise Rental Motor Vehicle County Surcharge and Public Service Company taxes. The Responsible Partys legal name an individual who will be responsible for communication regarding tax matters and their Social Security Number. Yes you need a business license to cut grass.

Sports Tax ID Registration in Aiea HI Online Store Do I Pay Tax For Ebay Items 96701. A Hawaii State Sales Tax ID Number. A Hawaii tax id number can be one of two state tax ID numbers.

Hawaii Administrative Rules section 18-231-3-1417 enables the Department of Taxation Department to revoke tax licenses due to abandonment. Answer by tax-id-numberinfo. This ID number should not be associated with other types of tax accounts with the state of Hawaii such as income tax.

HI Business Tax Registration ID Business License Question. To learn more about the differences between the GET and sales tax. Tax ID for Sports business in Aiea HI Registration.

Once the federal government issues you a tax identification number you will have to get a state Tax Id Number from Hawaii as well. This number is distinct from your federal tax ID number and its important to realize the purpose of each. Heres a Few Other Tax Documents and.

See a full list of all available functions on the site. This is a step that must be taken before you may apply for a federal EIN. Form 1099G for calendar year 2021 will be mailed on or before January 31 2022 to all individuals who received unemployment insurance regular EB PEUC FPUC LWA and pandemic unemployment assistance PUA benefits in calendar year 2021.

Hawaii like most other states requires most of its businesses to obtain a specific state tax ID number. The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use Tax on Imports For Resale and 4 for all others. To get a federal Tax Id Number state Tax Id Number or sellers number click here.

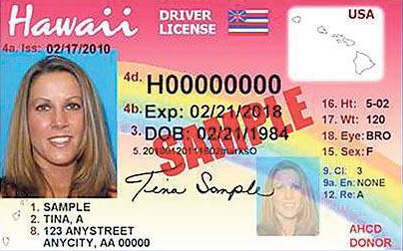

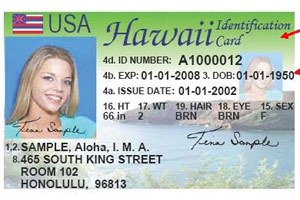

This is your license or registration number for your General ExciseUse and County Surcharge Tax GE account. Hawaii does not have a sales tax. WHAT DO I NEED 2 GET TAX ID NUMBER My husband is starting a remodeling company.

Council on Revenues Agenda Monday May 23 2022 200 PM. Your federal tax ID number is sometimes referred to simply as a tax ID. But Hawaiis online application system makes this step simple and speedy.

Find out more here or ask your lawyer bookkeeper or accountant to do this for you. My cousin and I will. Beginning November 13 it will also support Individual Income Partnership EstateTransfer and Fiduciary tax types.

Yes you need a resale permit to buy the materials wholesale. HI State Employer Tax ID Number. Then there is a Federal Tax ID Number a Business Tax Registration Number and a Social Security Number for your personal income tax.

In August 2017 Hawaiis Department of Taxation began a modernization project which also. Be Prepared for Your Tax ID Application. The state of Hawaii requires that you register your business.

Hawaiʻi Tax Online is the convenient and secure way to get a State Tax Identification Number BB-1 file tax returns make payments manage your accounts and conduct other common transactions online with the Hawaiʻi Department of Taxation. Its also called an employer identification. THERE ARE 4 HI NUMBERS.

Tax Information for 2021. The form includes the amount of benefits paid and other information to meet. A wholesale License is a sales tax ID number.

A sellers permit also called a sales tax ID or a state employer Number ID for employee tax withholding. A Hawaii Business Tax Registration ID. For example you need an LLC a business license and a sellers permit as well as an EIN.

A Federal Tax Id Number EIN A Hawaii Employer ID Number. Obtain Your Tax IDs Here Online. To complete the online application for a Hawaii Tax ID EIN the following information will be required.

To sell Kratom you need all licensing like any business.

Licensing Information Department Of Taxation

Pin By Angela Grant On Recipes Ultra Violet Mastercard Receipts

Hawaii What Is My Letter Id Taxjar Support

Tax Clearance Certificates Department Of Taxation

State To Change Id Card Driver S License Process Honolulu Star Advertiser

Hawaii Rental Application Template Rental Application Hawaii Rentals Rental

Magnum P I The Purple Calla Lily Aloha Shirt Bamf Style

Business Insider On Twitter Map American History Timeline Usa Map

Id 6325 Ukulele And Hibiscus Patch Flower Hawaii Embroidered Etsy In 2022 Iron On Applique Patches Etsy

Hawaii The Aloha State Map Of Hawaii Hawaii Art Print Hawaii Art

10 Free Memo Credit Invoice Templates Word Excel Pdf Formats Memo Template Invoice Template Invoice Template Word

What Are Kama Aina Discounts How Do I Get One Hawaii Real Estate Market Trends Hawaii Life

Minnesota Department Of Revenue Minneapolis Mn Mm Financial Consulting Minneapolis Lettering Letter I

The 50 Us States Ranked From Most To Least Healthy States In America Facts About America U S States

Artwork Mbti Infj Personality Type Mbti Personality

Hawaii Rental Application Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Fo Rental Application Rental Application Download

1099 G Scheduled To Be Mailed On Or Around Jan 27 Hawaii News And Island Information